Record exports and a recovering domestic market put upward pressure on pork prices

In the foreign market, possible embargoes should not impact the pace of meat shipments in general. Soybean exports can reach high volumes, which draws attention to the domestic market

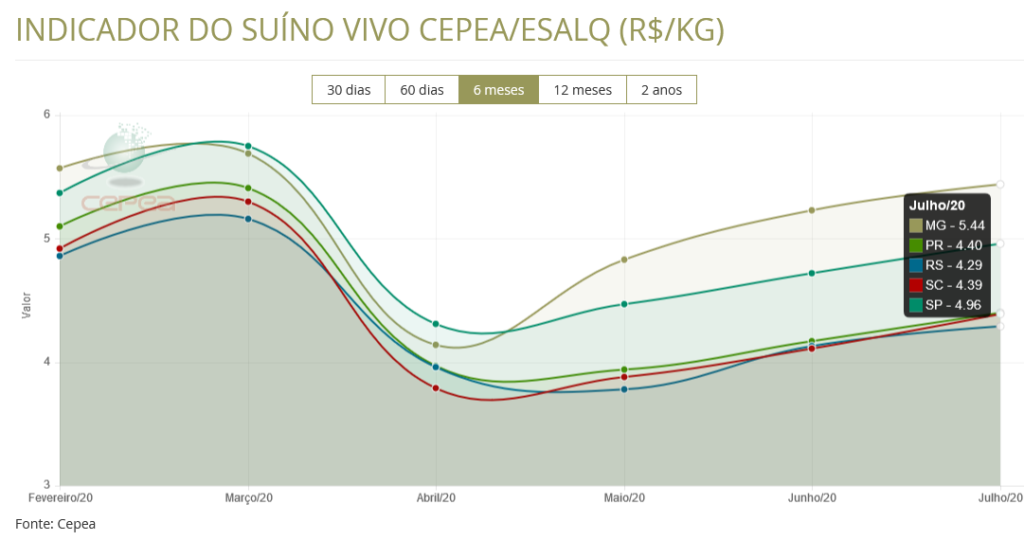

When analyzing the current scenario of the pig market, it is clear that signs of recovery have appeared in relation to the price of pigs. According to data from Cepea, several regions of the country have seen rising prices in recent months and current prices are already reaching March values. As for shipments, the pace continues to increase, which has reduced supply in the domestic market, also resulting in an intensification of the search for live pigs and an increase in prices.

Price paid to producers approaches “pre-pandemic” levels

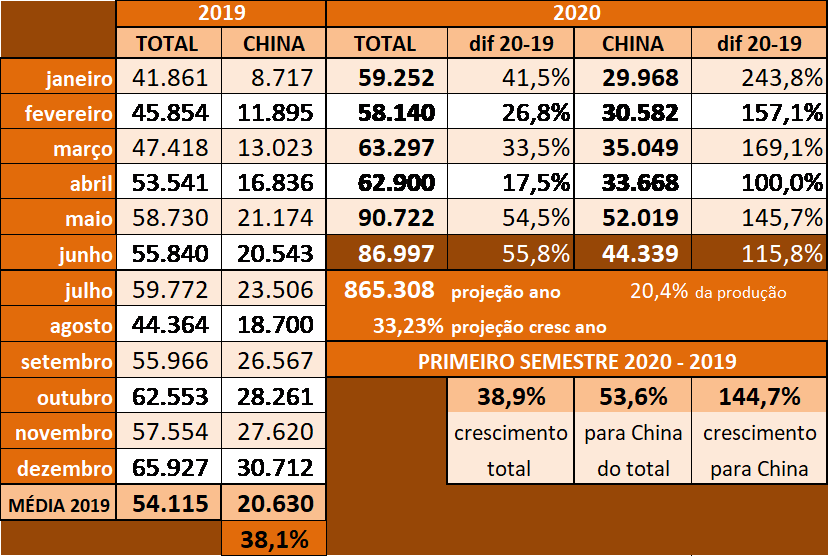

After record shipments in May, in June export volumes fell slightly, but still remained at a level well above historical monthly averages, closing the month with almost 87 thousand tons of pork in nature (Table 1). In the first half of 2020, total export growth was 38.9% compared to the same period last year. The quantity shipped to China in June was also the second largest in a single month, with just over 44 thousand tons. So far this year, more than 225 thousand tons have already been exported to the Asian giant, an accumulated growth in the first half of the year compared to the same period in 2019 of around 115.8%

July exports started very well, with more than 41 thousand tons of pork in nature until the 10th (5,186.3 tons per working day). As the month of July will have 23 working days, Brazil will certainly break a new monthly record for shipments with volumes exceeding 100 thousand tons.

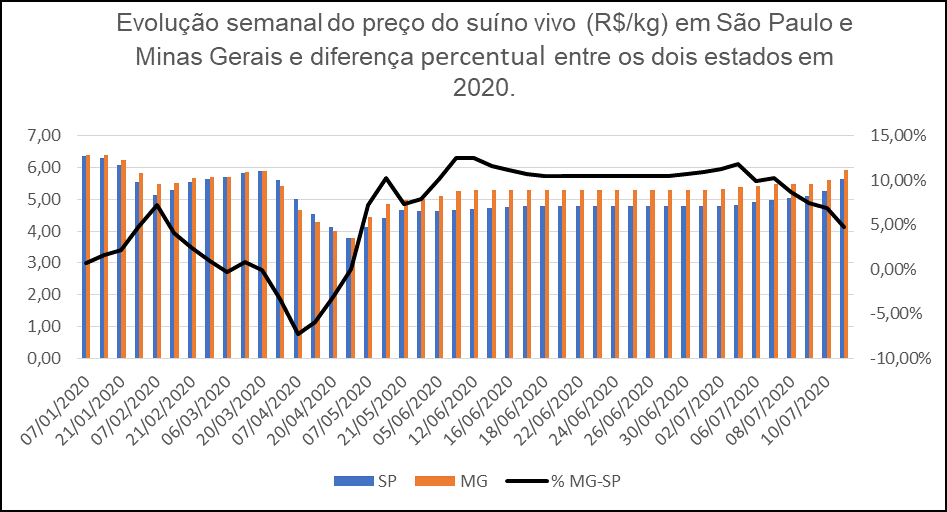

Prices paid to producers are getting closer to the levels practiced before the pandemic (graph 1). The price reaction began in May, when exports reached a historic record and, with the recent easing of isolation measures and reopening of food service, especially in large consumer centers such as São Paulo and Rio de Janeiro, the domestic market also shows an increase in demand. Proof of this is that, after several weeks of highs, the BH Stock Exchange closed on June 9th at R$ 6.10/kg live.

The “decoupling” of the price of Minas Gerais in relation to other states, which began in the second half of April and reached its peak in June, is already showing clear signs of reversal, showing that the rest of Brazil is also gaining speed in the recovery of prices. amounts paid to producers. Graph 2, which compares prices paid in Minas Gerais and São Paulo, according to a CEPEA survey, clearly demonstrates this. The difference in favor of the Minas Gerais price, which reached more than 12% at the beginning of June, on July 13 fell to 4.78%.

According to CEPEA, not only the live animal, but also pork carcasses and cuts followed the same upward trend, and for cuts the valuations were even more significant, causing the June averages to exceed those of the same month in 2019 Furthermore, according to CEPEA, in addition to the increased demand, supply was more limited, as some slaughterhouses have been operating on smaller scales, due to sanitary measures to prevent coronavirus.

Regarding Covid-19, an “internalization” of the pandemic has been observed in recent weeks, which has actually affected some slaughterhouses. It is important to highlight that pigs or any other species of livestock farming, NO transmit or are affected by Covid-19, but the eventual and temporary closure of plants is due to the work environment, which can increase the risk of contagion among employees. Therefore, when many cases are diagnosed among employees and the slaughterhouse does not have sectorization measures and work schedules that allow part of the affected team to be isolated, it ends up having to suspend slaughter for a few days or weeks.

Despite technically unfounded threats from China to embargo meat processing plants with cases of Covid-19 in their teams, according to MBAgro, any suspensions should not impact the pace of meat exports in general, given that Brazil has 102 plants qualified to export meat to China.

Successive soybean export records put domestic meal availability at risk in the second half of the year

According to MDIC, in the year to June, more than 60 million tons of soybeans were exported, a record volume, with China as its main destination. According to MBAgro, the devalued exchange rate favors export logistics, making it cheaper. In this scenario, Brazilian exports could reach 82 million tons in 2020 (last year it was just over 74 million) and reduce the domestic soybean market, reducing crushing and the availability of soybean meal.

Furthermore, according to MBAgro, there is the possibility of Brazil importing soybeans to meet strong demand, which reverses the logic of soybean pricing, since it will be the import parity, and no longer the export parity, that will define the price. in the domestic market. If this happens it will be something unprecedented in the Brazilian market. The second half of 2020 will be very tight for the national industry and buyers of soy products.

In the domestic market, soybean prices (graph 3) and derivatives remain firm, supported by internal and external demand. According to CEPEA, national industries show a need to acquire grain in the short term, at the same time that new export negotiations have been carried out.

Probable record corn harvest does not guarantee low prices for this input

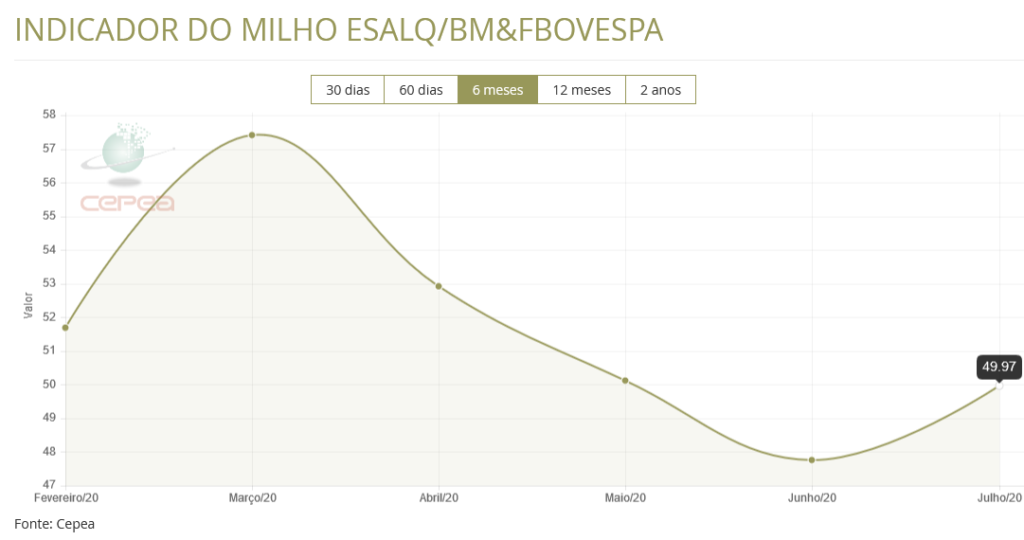

With 25% of corn area from the 2nd harvest already realized, CONAB's expectation is for a production of 100.5 million tons in the 2019/20 harvest, a new historical record. However, according to CEPEA, internal and external corn prices continued to rise at the beginning of July in Brazil (graph 4), and values have been supported by the retraction of sellers, who avoid negotiating large lots, and by consecutive increases in ports. and the increase in freight prices.

As the majority of corn exports occur in the second half of the year, the prospect is that foreign sales will gain pace in the coming weeks. According to MBAgro, shipments are estimated at around 32 million tons (last year there were more than 40 million). This amount would be enough to balance the internal market. Although external demand for corn is not as high as that for soybeans, the very devalued Real could favor an even greater shipment of this grain, resulting in a similar situation to soybeans in terms of internal shortages.

According to the president of the Brazilian Association of Pig Breeders (ABCS), Marcelo Lopes, pig farmers must be prepared to purchase corn in small “windows” of price drops during the harvest of this second crop, which should last until August.

He also highlighted that, with the price crisis in the sector easing, it is time to refocus on the structural investment of farms to adapt to the ever-increasing demands of the consumer market. “The producer, before thinking about increasing the scale of production, must add technology with a focus not only on productivity, but also on issues of animal welfare, biosecurity and responsible use of antimicrobials, among others.”

The president of ABCS also reinforced the importance of measures to prevent the spread of Covid 19. “Everyone's care regarding Covid-19 must be redoubled, as there is an intense internalization of the pandemic in Brazil and, as long as we do not have a vaccine, even with the disease receding in some cities, prevention measures must be applied in the best possible way”.

Source: http://abcs.org.br/