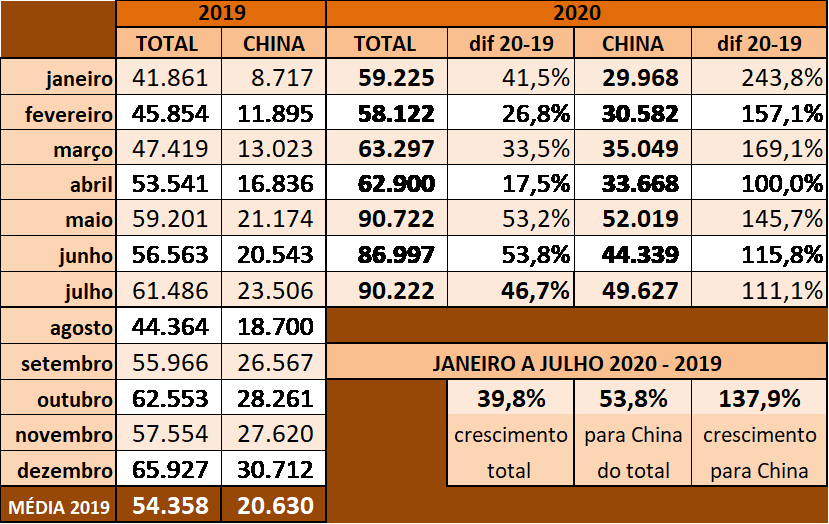

Although the last week of July had relatively low export volumes (13.6 thousand tons), when compared to other weeks this year, the month ended with a volume very close to the monthly record that had previously been achieved in the month of May , when 90.7 thousand tons of pork were exported in nature (MDIC). In August, in the first three weeks, 62,742 tons were shipped, that is, just over 4 thousand tons per working day. With six more working days, maintaining daily averages, the expectation is that the month will close slightly below 90 thousand tons, maintaining the average of previous months.

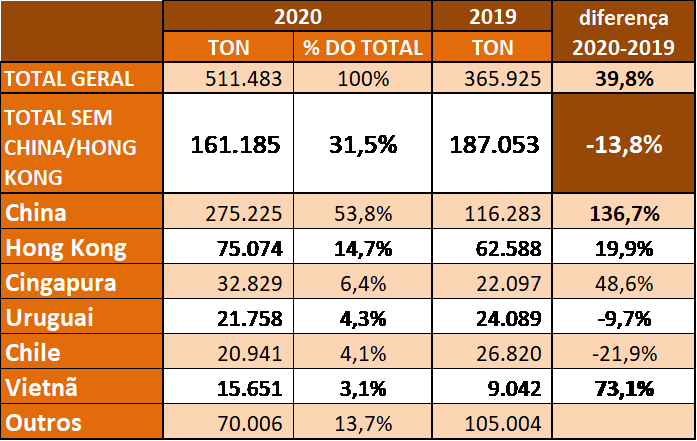

The increase in exports to Vietnam draws attention (table 2), especially in July when almost 7 thousand tons of Brazilian pork were shipped to this destination. With around 100 million inhabitants, Vietnam is an important producer and consumer of pork and, due to the arrival of African swine fever last year, it imported around 67 thousand tons of pork. For this year the estimate is more than 100 thousand tons imported and, with the recent activation of new plants, Brazil is an important supplier for this destination. However, our dependence on exports to China and Hong Kong is increasingly greater (table 2), closing these first 7 months of the year at almost 70% of all shipments, with China increasing its purchase by almost 140% in relation to the same period 2019 (table 1).

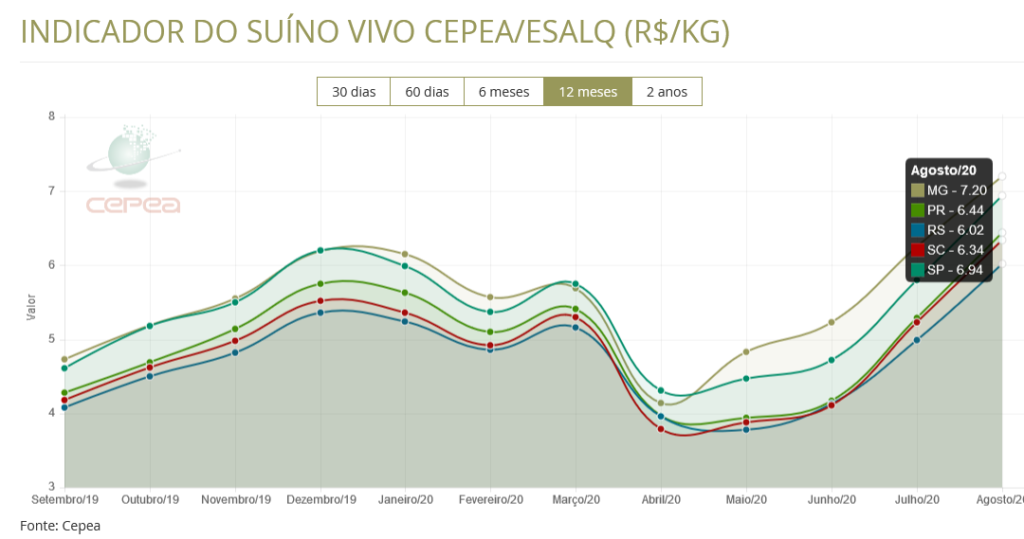

In addition to exports, the rise in live pig prices was amplified (graph 1) by the low supply of animals in ideal weight for slaughter and the partial reopening of trade in important consumer regions. According to CEPEA, average pig values reached real record levels in the Cepea series, which began in 2002. In July, in the West of Santa Catarina, the increase in the month was 22.7%; in Southwest Paraná, the monthly appreciation was 24.5%; in Ponte Nova (MG), the monthly value of live pigs was 20.7%. Furthermore, according to CEPEA, in the Greater São Paulo wholesale market, special pork carcasses increased in value by 19.3% from June to July, reaching R$ 8.54/kg in the last month. For common carcass, the price increase was 18.6% in the same period, quoted at R$ 8.18/kg.

The real record (corrected by IGP-DI) for the price paid per kg of live pigs hitherto recorded by CEPEA was R$ 7.78 in December 2004, in the region of Ponte Nova (MG). Recently, on 08/13/2020, the BH Stock Exchange (BSEMG) set a historic record, closing a deal at R$ 7.80.

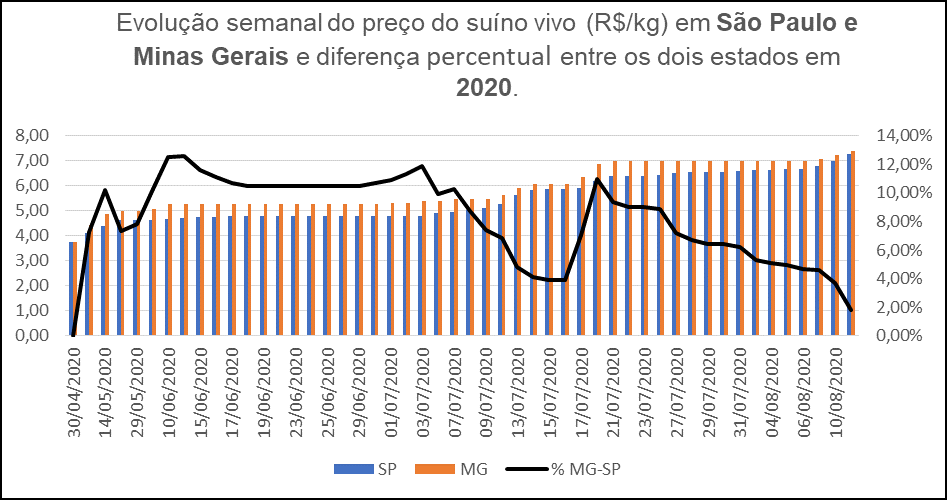

The “detachment” of the price of Minas Gerais observed in relation to other states, which began in the second half of April, reached its peak in June and continues to fall, returning to levels below 3% and showing that the rest of Brazil also gains speed in recovering amounts paid to producers (graph 2).

This dizzying growth in pork prices in the independent market throughout Brazil raises the natural question: Is pork too expensive for consumers? The answer to this question cannot be based solely on absolute numbers or percentages of price increases, caused by the evident shortage of pigs available to supply the domestic market. It is also necessary to monitor the evolution of beef cattle prices, as the rise in beef prices gives more room for the competitiveness of pork at retail. According to CEPEA, in the August partial (until the 12th), the CEPEA/B3 Indicator (São Paulo, in cash) recorded an average of R$ 226.97 per fat cattle @ (graph 3), the highest value, in terms reais, considering the entire Cepea series, started in 1994 (values deflated by the IGP-DI). According to Cepea, in addition to the low supply of animals ready for slaughter, the heated international demand continues to support domestic prices. The total beef exported this year (until July) is 16.4% more than the same period last year (MDIC). China stands out with the biggest growth, with 451.8 thousand tons exported between January and July 2020, compared to 175 thousand tons in the same period last year (growth of 158.2%).

Slaughter data from the first quarter of 2020 demonstrates the strength of Brazilian pig farming

The preliminary data on animal slaughter in the second quarter of 2020 published by IBGE on the 12th, demonstrate a trend that has been observed for some years. Pork production has been growing continuously and consistently, in relation to chicken and beef (table 3).

Pig production in the first half of 2020, compared to the same period last year, saw growth in both the number of animals slaughtered (+5.46%) and the average weight (+2.24%), which determined an increase in the total volume produced in the order of 7.82%. If the averages from the first half of the year are maintained until the end of 2020, we will have an increase compared to last year of around 5%, consolidating pork as the fastest growing protein in the country, which can also be demonstrated in the numbers from recent years in the table 4, below, when pork production rose more than 20% from 2015 to 2019.

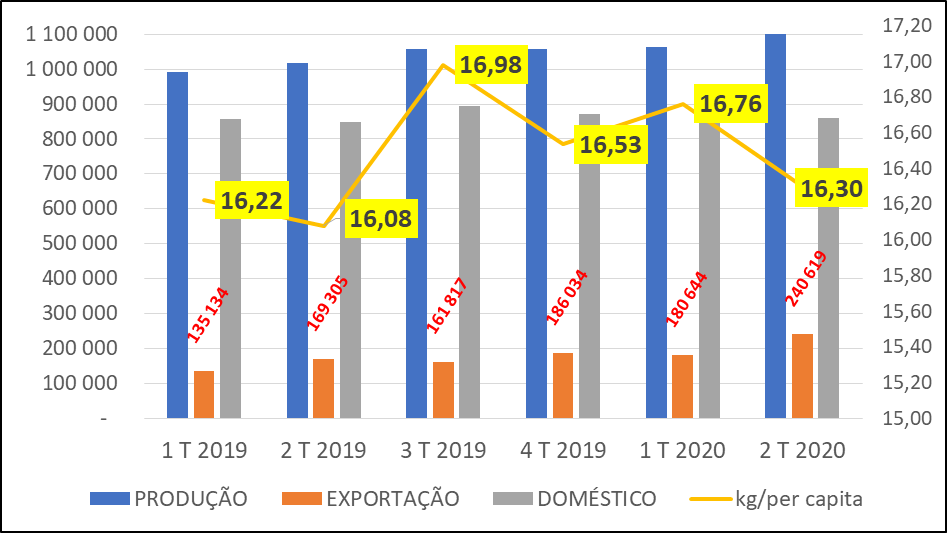

Extrapolating these production numbers, which are still preliminary from IBGE, and subtracting the export data, it is possible to estimate how much per capita domestic consumption is (graph 4). And, despite the economic and health crisis caused by Covid-19, and the increased exports that put upward pressure on domestic market prices, Brazilian consumption remains relatively high, and in the first half of 2020, an increase in the per capita consumption per year of more than 380g (2,36%) compared to the same period last year, considering the same population.

Record national corn production and risk of soybean meal shortages

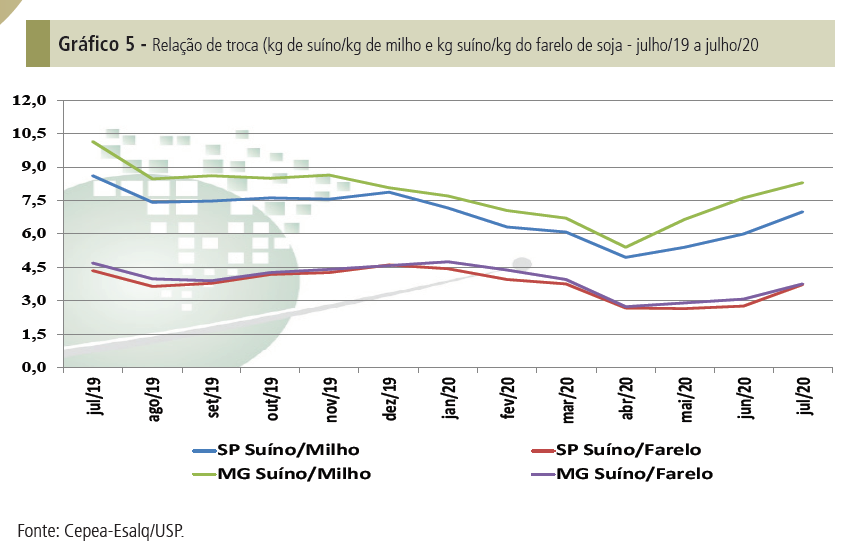

With the overvaluation of soybeans and corn, the cost of production has remained high, but due to the significant recovery in the price of pork in recent months, the exchange relationship between the value of the pig and the main inputs (corn and bran of soybeans), rose again (graph 5), which determines the profit margin in the activity. The biggest concern is the upward trend in inputs until the start of the 2020/21 summer harvest and, mainly, the risk of shortages, especially of soybean meal.

Corn

CONAB released the 11th survey of the 2019/20 harvest, projecting the second corn harvest, already in the final stretch of harvest, for a total of 74.92 million tons, an increase of 1.4 million tons. in relation to the previous survey. If this number is achieved, the total corn harvest (2019/20) will reach a record value of 102.1 million tons. Accumulated exports from January to July are still 51% below that recorded in the same period last year. Also according to CONAB, to reach the estimate of 34.5 million tons to be exported for this crop year, Brazil must ship a monthly average of 4.8 million tons until January 2021. At this rate, final stocks are estimated at 10.3 million tons. However, in the first week of August alone, 2.04 million tons (MDIC) were shipped. It is necessary to pay attention to the volumes exported in the coming months, but, in principle, there should be no shortage of corn. Farmers, relatively capitalized, are very parsimonious when selling grain, which has kept the value of corn high even during the peak of the second harvest harvest (graph 6).

Soy

Soy continues to break successive price records in the domestic market (graph 7) and shipments. The estimate for Brazilian soybean exports remains very high due to the strong volumes of early marketing of the 2019/20 harvest and the high dollar. Accumulated exports from January to July 2020 approached 71 million tons (MDIC), while, in the same period in 2019, this value was 51.17 million tons. According to CONAB, the estimate is that Brazil will export approximately 82 million tons of soybeans in 2020, and the expected domestic demand (crushing and other uses) is 47.6 million tons, totaling 129.6 million tons . As the carryover stock from 2019 to 2020 was very low and production in 2020 was 121 million tons, there will be a soybean deficit of more than 8 million tons. Some analysts believe that, depending on the exchange rate and Chinese demand, oilseed exports could reach close to 88 million tons, which would worsen the risk of shortages in the domestic market. More recently, on August 13, the National Petroleum Agency (ANP) determined the temporary reduction of the percentage of mandatory blending of biodiesel with diesel oil from the current 12% to 10% in the two months of September and October 2020. This is a factor which should reduce the demand for crushing in the country, further reducing the supply of soybean meal. The situation indicates a high risk of shortages of soybeans and their derivatives and is a factor of real concern for the sector until the start of the next harvest, in January 2021.

Final message to pig farmers

For the president of ABCS, Marcelo Lopes, the preliminary data is a source of pride for pig farmers, “as they demonstrate that livestock farming is the fastest growing activity in recent years, even in the face of successive crises.” According to him, this confirms the resilience and competence of producers and is also the result of many years of work by ABCS and its affiliates with retailers and consumers because, although the export market has grown significantly in the last year, the domestic market continues being the destination of more than 80% of Brazilian production. “The good financial margins recorded in recent weeks determine the resumption of the modernization agenda of our farms, adapting them to the growing demands of the consumer market. The focus on the strategic and advance purchase of inputs is another point that should receive increasing attention from the sector from now on, on a path of no return”, he concludes.

Source: ABCS